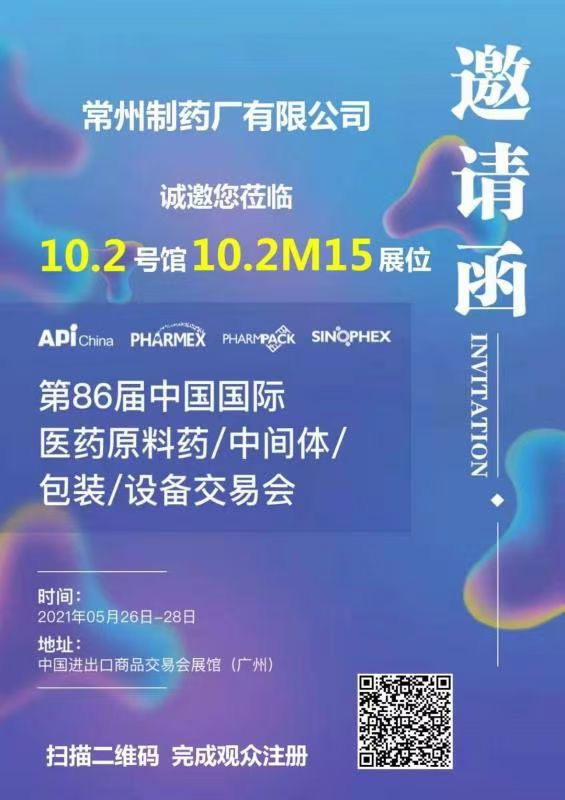

The 86th China International Pharmaceutical Raw Materials/Intermediates/Packaging/Equipment Fair (API China for short)

Organizer: Reed Sinopharm Exhibition Co., Ltd.

Exhibition time: May 26-28, 2021

Venue: China Import and Export Fair Complex (Guangzhou)

Exhibition scale: 60,000 square meters

Exhibitors: 1500+

Audience number: 60000+

We, Changzhou Pharmaceutiacl Factory owned by Shanghai Pharma., will attend he China Import and Export Fair Complex (Guangzhou) at 10.2M15 for the 86th China International Pharmaceutical Raw Materials/Intermediates/Packaging/Equipment Fair (API China for short)

In recent years, my country has successively issued a series of policies to encourage and support the development of the biomedical industry. In this context, the biopharmaceutical industry has also begun to enter a stage of rapid development, and has shown increasingly strong growth potential. At present, its market growth rate has begun to gradually exceed the overall situation of the pharmaceutical market. According to the Frost & Sullivan report, in 2019, China’s biopharmaceutical market reached 317.2 billion yuan. With the increase in affordability, the growth of the patient population and the expansion of medical insurance coverage, the biopharmaceutical market is expected to reach 464.4 billion yuan in 2021.

Then, in the face of the huge market prospects, what are the main lines of investment in the biopharmaceutical industry worthy of attention in 2021? According to the industry, based on the recent pullback of the pharmaceutical sector, it is recommended to pay attention to the three main investment lines under the general trend of industrial upgrading:

一. High-quality innovative enterprises with global competitiveness

Medicine has always been a sunrise industry with strong development. However, under the background that the pharmaceutical industry is entering high-quality development and the industry is accelerating its transformation, the development of innovative drugs by pharmaceutical companies is the key to solving the unmet clinical needs, sustaining and being competitive.

At present, from a global perspective, the major large pharmaceutical companies are all innovative drug companies. For example, the market value of Johnson & Johnson, which has medicine and equipment, is as high as 374.5 billion U.S. dollars, and the market value of top pharmaceutical companies such as Roche and Pfizer are also more than 100 billion U.S. dollars; but as Teva Pharmaceuticals, one of the world’s largest generic drug companies, has a market value of only $12.3 billion. It can be seen from the above that innovation has become a strong driving force for the better development of the biomedical industry and enterprises.

It is worth noting that if we want to have more markets, it is not enough to rely on the domestic market alone. Only by pushing internationally competitive drugs overseas and participating in the competition in the global market with more space can we have the opportunity to get better returns. . Therefore, the industry generally believes that high-quality innovative companies with global competitiveness have more development opportunities. It is recommended to pay attention to innovative pharmaceutical companies that have established overseas direct sales channels.

二.DRGs-related” beneficiary sector

In 2021, the actual payment of DRGs will start, which will have a profound impact on clinical diagnosis and treatment, medical insurance control fees, etc. For example, once DRGs are implemented, hospitals will, out of cost considerations, try to limit the use of some high-priced drugs, even for original research drugs, relevant pharmaceutical companies will suffer severe damage if they do not transform in time.

However, although some drugs and companies will be very challenged. However, the industry predicts that the varieties of drugs with strong consumption attributes, emergency drugs, end-stage treatment and outpatient drugs may not be affected, and under the cost-benefit assessment, it will promote the increase of ICL penetration rate and the import substitution of the IVD industry. In addition, core upstream resources (raw materials and equipment, patented APIs) may also benefit from this. It is recommended to pay attention to: WuXi Biologics, Tofflon, Kailai Ying and other companies.

三.Highly prosperous drug R&D outsourcing field

Under the influence of factors such as the overall increase in global pharmaceutical R&D investment and favorable domestic policies, it is a consensus in the industry that the drug R&D outsourcing service market (ie CXO), an important part of the innovative drug industry chain, will obviously benefit.

Industry insiders believe that start-ups are now gradually becoming the main force in the research and development of innovative drugs in the biomedical industry. However, due to the shortage of talents, funding, and space, start-ups usually streamline personnel and pursue high efficiency and low cost. Therefore, they are dependent on CXO companies. Tends to be higher. It is understood that a listed CMO company has stated that for the above reasons, the proportion of start-up bio-innovative drug companies in the performance of CXO companies has gradually increased in recent years, and it is also becoming an important source of contribution to the growth of CXO company revenue and profits.

Post time: May-13-2021